For organizations of every size, choosing and applying the right risk framework is at the heart of effective cybersecurity and information risk management. Risk frameworks provide the structure needed to identify, assess, mitigate, and monitor threats in an ever-evolving landscape. In this guide, we’ll explore what risk frameworks are, why they matter, review leading industry frameworks, and offer best practices for optimal implementation.

What Are Risk Frameworks?

A risk framework is a formalized set of guidelines and best practices designed to help organizations systematically manage and reduce risks to their information, systems, and operations. These frameworks guide organizations through defining risk, prioritizing controls, and continuously improving security posture.

Why Risk Frameworks Matter

- Consistency: Ensures security processes are repeatable, measurable, and aligned with business goals.

- Compliance: Helps organizations meet regulatory and industry requirements.

- Communication: Establishes clear language for discussing risks and mitigation across departments.

- Continuous Improvement: Facilitates ongoing adaptation as threats and business needs change.

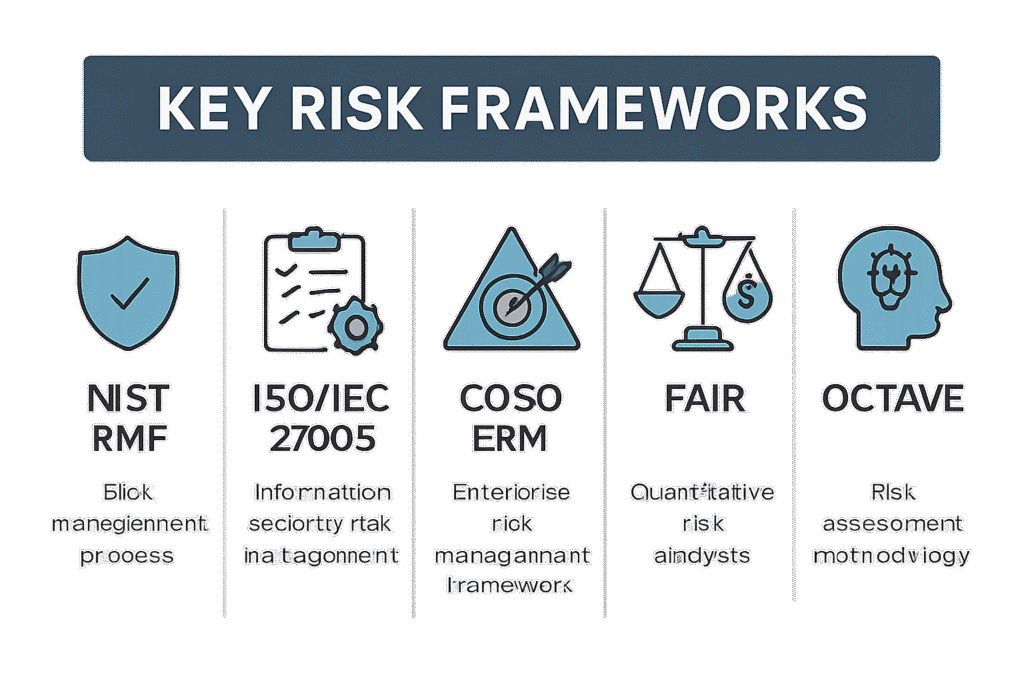

Key Risk Frameworks You Need to Know

NIST Risk Management Framework (RMF)

Developed by the National Institute of Standards and Technology, this comprehensive framework is widely adopted by government agencies, contractors, and critical infrastructure operators. It defines a lifecycle that includes:

- Categorize systems and data

- Select security controls

- Implement those controls

- Assess their effectiveness

- Authorize the system for operation

- Monitor controls continuously

Best for: Organizations that require a structured, step-by-step approach for high-assurance environments.

ISO/IEC 27005: Information Security Risk Management

This international standard is part of the ISO/IEC 27000 family, supporting organizations in establishing, implementing, and maintaining an information security management system (ISMS) by focusing specifically on risk. The core steps are:

- Establish Context

- Assess (Identify, Analyze, Evaluate) Risks

- Treat Risks

- Accept Risks

- Communicate & Consult

- Monitor & Review

Best for: Multinational and globally regulated companies seeking standardized, recognized best practices.

COSO Enterprise Risk Management (ERM)

COSO ERM offers an enterprise-wide perspective, focusing on governance, strategy, and performance evaluation—not just IT or security. Its integrated approach covers:

- Governance and culture

- Strategy and objectives

- Performance measurement

- Review and revision

- Information and communication

Best for: Organizations aiming to embed risk management into all levels and departments, including finance, operations, and IT.

FAIR (Factor Analysis of Information Risk)

FAIR is a quantitative model that translates risk into monetary terms, making it particularly valuable for executive stakeholders. Its process involves:

- Scoping risk scenarios

- Estimating probabilities and potential losses

- Calculating risk in financial terms

Best for: Organizations needing to justify cybersecurity investments or prioritize controls by business impact.

OCTAVE (Operationally Critical Threat, Asset, and Vulnerability Evaluation)

OCTAVE is a flexible, self-directed framework suitable for businesses of various sizes. Its phases include:

- Building threat profiles based on assets

- Identifying vulnerabilities across people, process, and technology

- Developing security and risk mitigation strategies

Best for: Small and mid-sized organizations, or those new to structured risk management.

Comparison Table: Risk Frameworks Overview

| Framework | Primary Focus | Approach | Ideal Use Cases |

|---|---|---|---|

| NIST RMF | Information Security | Lifecycle/Stepwise | Government, critical infrastructure |

| ISO/IEC 27005 | InfoSec Management | International | Enterprises, global standards |

| COSO ERM | Enterprise-wide | Governance | Large, multi-departmental orgs |

| FAIR | Quantitative Risk | Financial-based | Executive decision-making |

| OCTAVE | Asset-Centric | Flexible, self-guided | SMBs, newcomers |

Implementation Best Practices

- Assess Organizational Needs: Understand your regulatory environment, business objectives, and risk appetite before selecting a framework.

- Customize, Don’t Just Adopt: Tailor frameworks to match your technology, culture, and operational maturity.

- Get Executive Support: Secure buy-in from leadership to allocate resources and drive cultural change.

- Automate Where Practical: Use risk management tools for efficient monitoring, alerting, and documentation.

- Educate and Communicate: Train staff regularly and encourage open discussions about risk.

Frequently Asked Questions

Can I combine elements from different frameworks?

Yes. Many organizations create hybrid frameworks to address unique requirements and leverage the strengths of multiple models.

Will a risk framework ensure compliance by itself?

No. While frameworks align well with regulations, ongoing diligence in implementation and review is essential for true compliance.

How do I choose the right framework?

Base your decision on your industry requirements, corporate strategy, and the maturity of your current risk management processes.

Conclusion

Adopting a risk framework is about more than meeting checklists—it’s about enabling informed decision-making, defending your organization, and building resilience in the face of evolving threats. Choose the framework that’s right for your goals, adapt it to your context, and foster a proactive culture of security risk management. By doing so, your organization strengthens its foundation for secure, sustainable growth.